Along with a monthly premium, many medical services result in Colorado Health Insurance plan out-of-pocket costs. Understanding Colorado Health Insurance Out-of-Pocket Costs is vitally important and the topic of this blog.

One of our first ever client’s, Olivia, is a self-employed graphic designer. Olivia had been on the same plan for a very long time and was hesitant to switch health insurance plans due to confusion about out-of-pocket costs, despite a change in her needs. She had heard horror stories of others being hit with unexpected medical bills and wanted to avoid that at all costs.

We provided a thorough review of her current plan and compared it with other available options. By clarifying what out-of-pocket costs are, such as deductibles and out-of-pocket maximums, and how they would impact her finances, she was able to make an informed decision.

Ultimately, she chose a plan that offered better coverage with a lower out-of-pocket maximum. When she later needed physical therapy after a minor accident, she was relieved to find that her out-of-pocket expenses were minimal, allowing her to focus on recovery rather than worrying about bills.

Out-of-pocket costs overview:

Health insurance plan owners pay a monthly premium to maintain the health insurance coverage. Along with this monthly expense, many medical services result in plan out-of-pocket costs. The follow is an overview of health insurance out-of-pocket costs:

- The Costs

- How they occur over time

- Why?

- Cost Sharing

- Overuse

- Risk Management

- Responsible Use

- Plan Customization

Out-of-pocket costs typically include:

- Plan Deductible

- Plan Copayments

- Plan Coinsurance

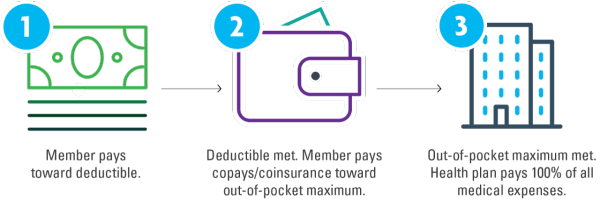

Out-of-pocket costs typically work as follows:

The premium is paid every month to keep the policy active. Wellness benefits are covered 100%. With all other medical services, the total amount for deductible, copay, and coinsurance costs is capped at the annual out-of-pocket maximum.

Cost wise it basically rolls out like this:

- Pay the premium every month.

- Pay 100% of most costs up to the deductible.

- Then pay copays or coinsurance up to the annual out-of-pocket maximum.

Why do I have these out-of-pocket costs?

Health insurance plans include costs like deductibles, copays, and coinsurance to balance the financial risk between the insurance provider and the policyholder.

Cost Sharing:

These out-of-pocket expenses ensure that the cost of healthcare is shared between the insurance company and the insured. This helps to keep premiums lower for everyone.

Prevent Overuse:

If healthcare services were completely free at the point of use, there could be a higher likelihood of people seeking unnecessary treatments. Deductibles and copays discourage overuse of medical services, helping to control overall healthcare costs.

Risk Management:

By requiring policyholders to pay a portion of their healthcare costs, insurance companies can better manage their financial risk. This ensures that they remain solvent and able to pay for large claims when necessary.

Encourages Responsible Use:

Cost-sharing mechanisms encourage individuals to make more informed and judicious decisions about their healthcare, such as seeking preventative care and choosing cost-effective treatment options.

Plan Customization:

Different levels of deductibles, copays, and coinsurance allow for various plan options, giving consumers the ability to choose a plan that best fits their financial situation and healthcare needs. Lower deductibles and copays typically mean higher premiums, while higher deductibles and copays generally mean lower premiums.

Informative Videos:

- Click Here to watch a Colorado State Exchange video which explains costs in more detail.

- Click Here to watch a Colorado State Exchange video which describes the health services covered on major medical plans.

- Click Here to watch an Ian Young Health Insurance video about how Health Insurance plans work.

Email Ian Young Health Insurance today or schedule an appointment for assistance with out-of-pocket costs and their impact on your decisions.